Urea

The local granular urea market continues to be slow due to weak demand, but prices remain strong off firm international free on board (FOB) prices. Major cropping areas recently received significant rainfall, which had the potential to drive demand, but local urea prices were too high for farmers to justify purchasing, one supplier said.

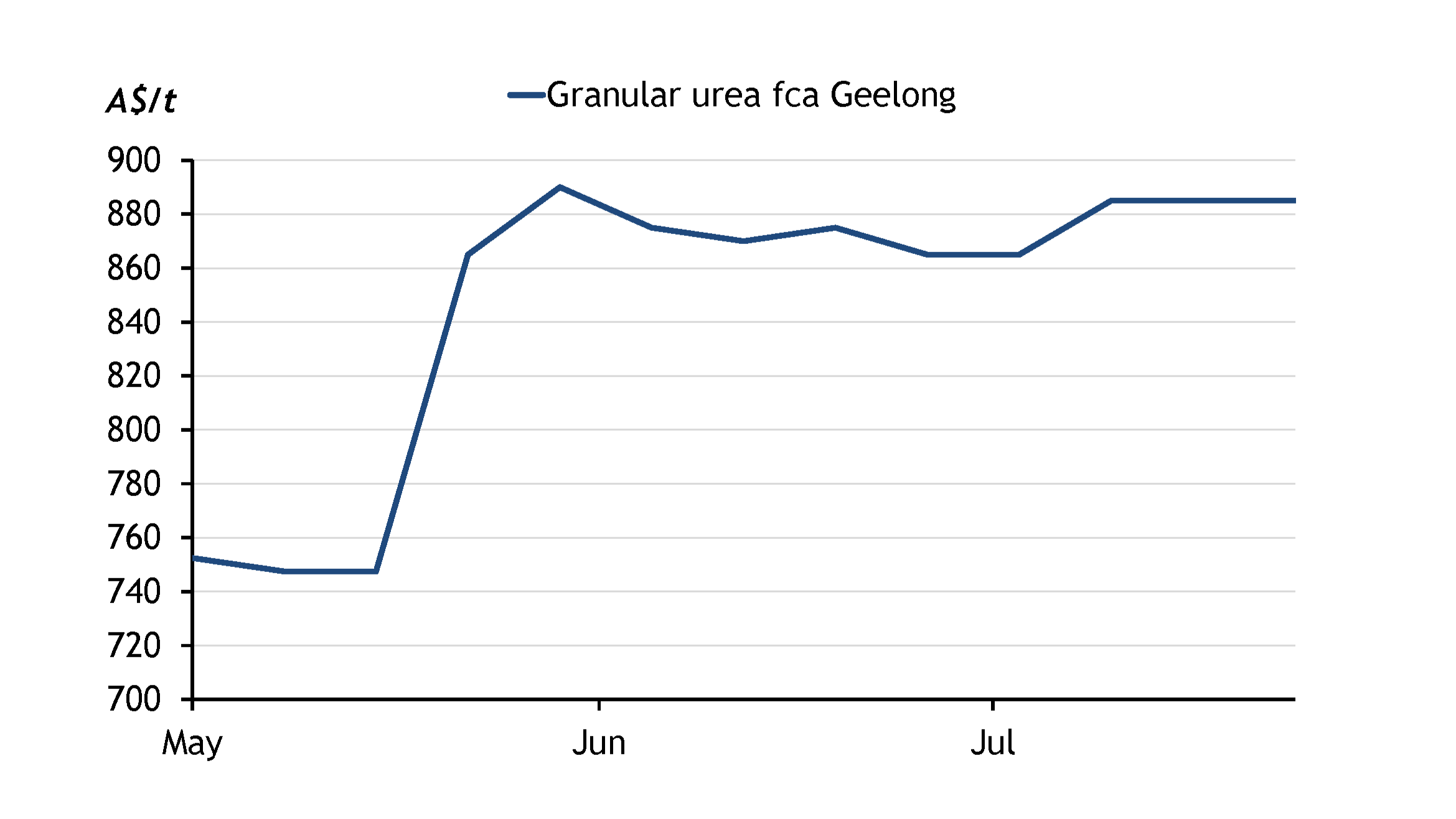

Granular urea prices were last assessed at A$880-890/t fca Geelong.

CSBP increased its urea price by A$92/t to A$1,004/t ex-Kwinana effective 19 August.

Chinese suppliers have received three urea export quotas since June, totalling 2 million tonnes, 1.3 million tonnes and an unconfirmed 700,000 tonnes. One supplier indicated additional Chinese tonnes in the international market would be unlikely to lead to a sharp drop in prices, thanks to strong demand in India.

Phosphates

Australian farmers are reluctant to buy any phosphate fertilisers at present as international FOB prices are high, and this has deterred early imports of MAP/DAP from Australian suppliers. Low affordability continues to be of concern to farmers and growers, explaining their hesitancy to enter the market.

Australia may benefit from the additional volumes allocated to Chinese phosphate producers and suppliers. Chinese volumes must be exported before 15 October. Australia imported 215,252t of MAP from China from September to December 2024.

News

Agri-business Ridley’s is on track to complete its A$300m ($193m) acquisition of Incitec Pivot Fertilisers (IPL) by the end of September, according to Ridley’s financial year results. A profit improvement plan for IPL will be made by December.

PRL Group announced on 20 August that it may transfer all shares in Centrex to PRL Group. The acquisition, including the transfer of shares, is still subject to several agreements that must be agreed by 31 August. PRL Group must still reach commercial terms with key logistics and operational counterparties for the Ardmore phosphate mine to be economically viable.

Australian mining company BCI Minerals will begin construction of a potassium sulphate (SOP) pilot plant located in the Pilbara region of Western Australia in early 2026.

The plant is part of BCI's Mardie salt and potash project. Construction will take 12 months, after which the pilot plant will run for one year. The SOP pilot plant will allow for end-to-end testing to de-risk the production process and will contribute to the end design of the final commercial plant, BCI said. BCI did not disclose the capacity of the plant.

Commentary and pricing supplied by Argus Media

Disclaimer: The information provided in this report is general in nature and is intended for informational purposes only.