General commentary

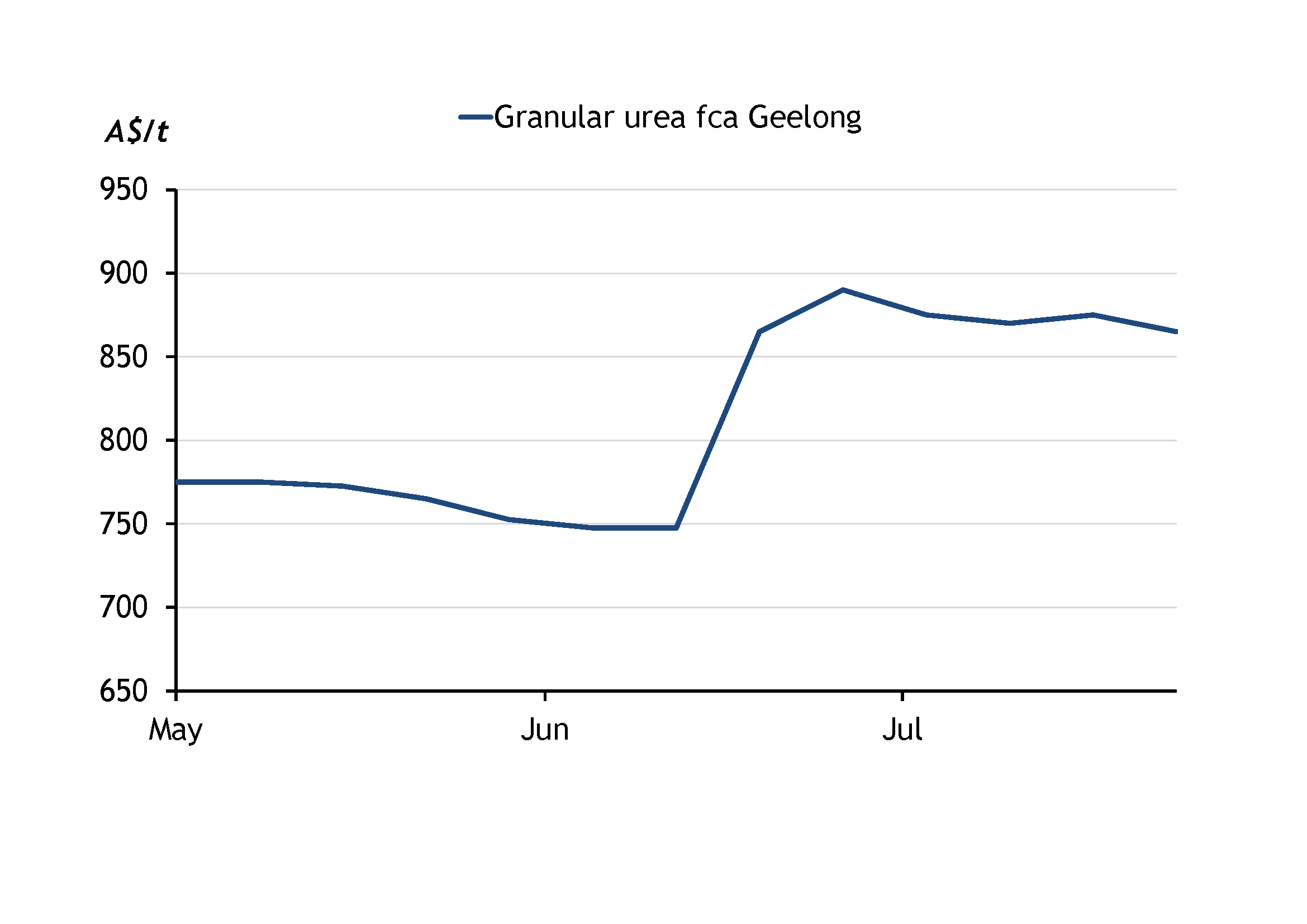

The Australian urea market remains slow because of tight prompt supply in July and high international free on board (FOB) prices, but there is still consistent demand from farmers, which has kept prices strong and stable.

The global urea market tends to react to Indian tenders and Australia is not exempt from this. Argus assessed local prices at A$860-880/t fca Geelong on 10 July before the latest Indian tender. The lowest prices offered in the tender were US$494/t cfr west coast and US$495/t cfr east coast. Australian local prices firmed up promptly, and Argus assessed the price at A$870-890/t fca Geelong on 17 July.

Prompt supply along the east coast is very tight due to supply chain complications in the Middle East in June and Australian suppliers reducing their buying programmes when rainfall was low in April and May.

Demand from growers for the summer and spring cropping season will emerge soon for both nitrogen and phosphate-based fertilisers. Urea imports for the month of July will total 377,000t, according to vessel tracking data from Kpler.

In July and August of 2024, MAP and DAP imports were 37,667t according to the Australian Bureau of Statistics. But there are no MAP or DAP imports scheduled so far for July and August this year, delivered or in transit, according to vessel tracking data from Kpler.

There is a favourable rainfall forecast for much of southern Australia, all of Victoria has a forecast of at least 10mm and all of New South Wales has a forecast of at least 1mm for August, according to the Bureau of Meteorology (BoM). South Australia has less rainfall expected; the northern parts of the state expect no rainfall, the most is expected in the southeast of the state, up to 50mm of rain in August.

Low-emissions nitrate fertilisers

The NSW Government will invest A$26.2m into renewable technology projects, including Australian manufacturer Plasma Leap Technologies (PLT). PLT will receive A$2.6m to test its method of making low-emissions nitrate fertilisers. This technology aims to build a small, low-emission fertiliser unit. The project’s plan is for calcium nitrate or ammonium nitrate to be delivered to on-site units on growers’ farms or at local hubs.

Commentary and pricing supplied by Argus Media

Disclaimer: The information provided in this report is general in nature and is intended for informational purposes only.