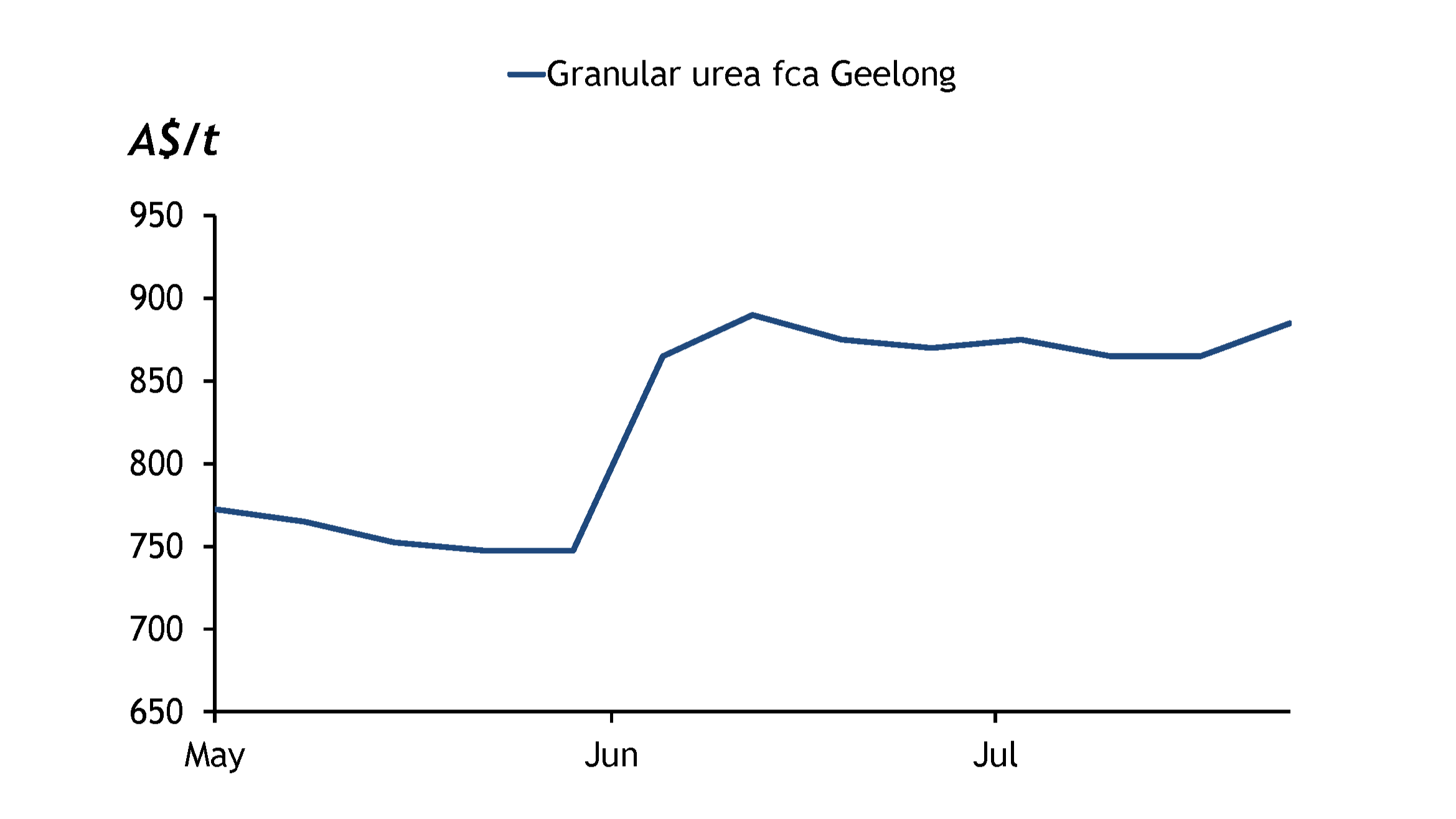

Local urea prices moved up on the back of firmer international free on board (FOB) prices and are expected to rise further.

Local prices for granular urea were last assessed at A$880-890/t fca Geelong.

Urea demand on the East Coast is winding down. Due to rain arriving later than usual, the whole season has been delayed, one importer said. Both topdressing and harvesting will be later than usual.

Stocks on the East Coast are inconsistent, with some suppliers sold out and others with urea available. Available stocks may slow the rise in local prices as the market reacts to the high international FOB prices.

Australian urea imports between January and June totalled 2.3 million tonnes, a 7% decrease from 2.5 million tonnes for the same period in 2024, according to the Australian Bureau of Statistics. Although urea imports are down on the year, imports in 2025 are still above average. This decrease is driven by a 35% drop in imports in June.

The Bureau of Meteorology’s (BOM) three-month rainfall outlook for August to October shows a 75% chance of at least 25mm of rainfall for most of Australia's southeastern regions, including all of Victoria.

The BOM’s climate outlook predicts a neutral Indian Ocean Dipole (IOD) until at least August, a negative IOD range in September and October, and a return to neutral in November. A negative IOD will likely result in strong crop outputs, especially from WA cropping areas.

It is unlikely that Chinese phosphate suppliers will receive any further MAP and DAP volumes for export until October. Importers are becoming increasingly concerned about the potential short supply of MAP from China for delivery to Australia in 2026 onwards.

The Australian, South Australian and Tasmanian governments provided critical metals producer Nyrstar with an A$135m funding package for transitional support for the company’s Port Pirie and Hobart operations, Nyrstar said on 5 August. This is seen as a positive sign in the market for Glencore’s Mount Isa copper smelter and refinery, which is currently seeking government support to keep its operations running. The smelter currently supplies sulphuric acid to IPL’s (Dyno Nobel) phosphate hill site, which produces MAP and DAP.

Commentary and pricing supplied by Argus Media

Disclaimer: The information provided in this report is general in nature and is intended for informational purposes only.