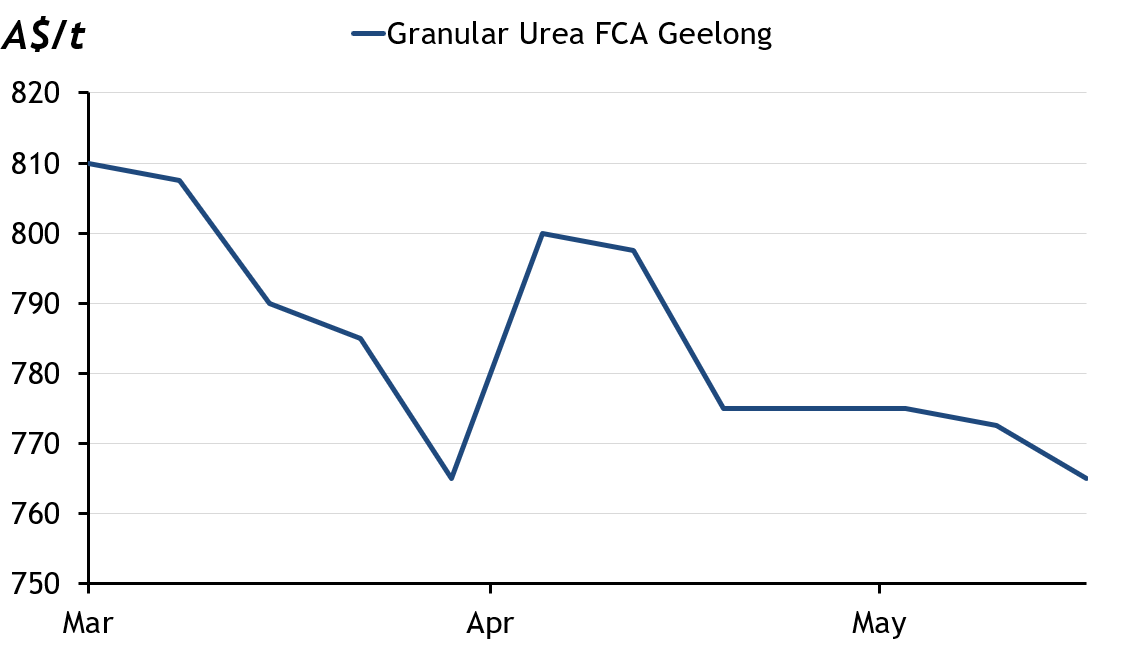

Urea prices fall in Victoria

Prices for granular urea sold from warehouses in Geelong fell over the previous two weeks but volumes exchanged between suppliers and buyers continue to be minimal.

Market participants are looking closely at how much rainfall there will be across the state of Victoria and then how forecasts for rainfall in June develop. Satisfactory short-term rainfall levels and then favourable rainfall forecasts should spur buying activity which has so far this month been very slow. Urea stocks along the east coast of Australia are probably lower than this time last year according to some market participants and there could be a squeeze on supply if rainfall spurs buying appetite. This means importers will have a short period of time to organise additional cargoes or, on the other hand, if rainfall fails to materialise, some importers may look to cancel cargo deliveries for July and September.

Dry conditions cut South Australian urea use

Around half of the growers in South Australia are using less fertilizer this season on the back of very dry weather conditions, according to a seeding intentions survey by Grain Producers South Australia (GPSA).

The survey also showed seeding has been delayed, with 64pc of growers saying they had not started seeding by Anzac Day on 25 April, historically seen as the benchmark to have seeding completed or at least started.

Australian fob DAP/MAP prices firm

Australian phosphate prices continued to increase with the latest DAP sale to India netting back to Townsville at firmer values. Local phosphate demand is now minimal with nearly all production aimed at export markets.

Future of Phosphate Hill

Phosphate Hill was not included in the sale of Incitec Pivot Fertilisers to Ridley’s but the firm will have access to ongoing supply from Phosphate Hill through an offtake agreement, but operations are subject to a strategic review that will be concluded no later than September this year. If the strategic review results in the closure of Phosphate Hill, Ridley expects supply to continue for another year until September 2026. The firm is confident it will be able to source the required product from global markets if it needs to do so.

Dyno Nobel is "continuing to engage with a party that is conducting due diligence" on the purchase of Phosphate Hill, according to chief executive Mauro Neves.

Dyno Nobel plans to cease manufacturing SSP at its Geelong plant in September this year, while Ridley expects the closure to be completed by December of this year.

Commentary and pricing supplied by Argus Media

Disclaimer: The information provided in this report is general in nature and is intended for informational purposes only.