Urea

Local demand for granular urea strengthened after Kaltim’s latest sell tender in which multiple Australian importers bid. Demand also grew because of India’s falling urea stocks indicating the need for a buy tender in February, which could pressure supply for Australian imports.

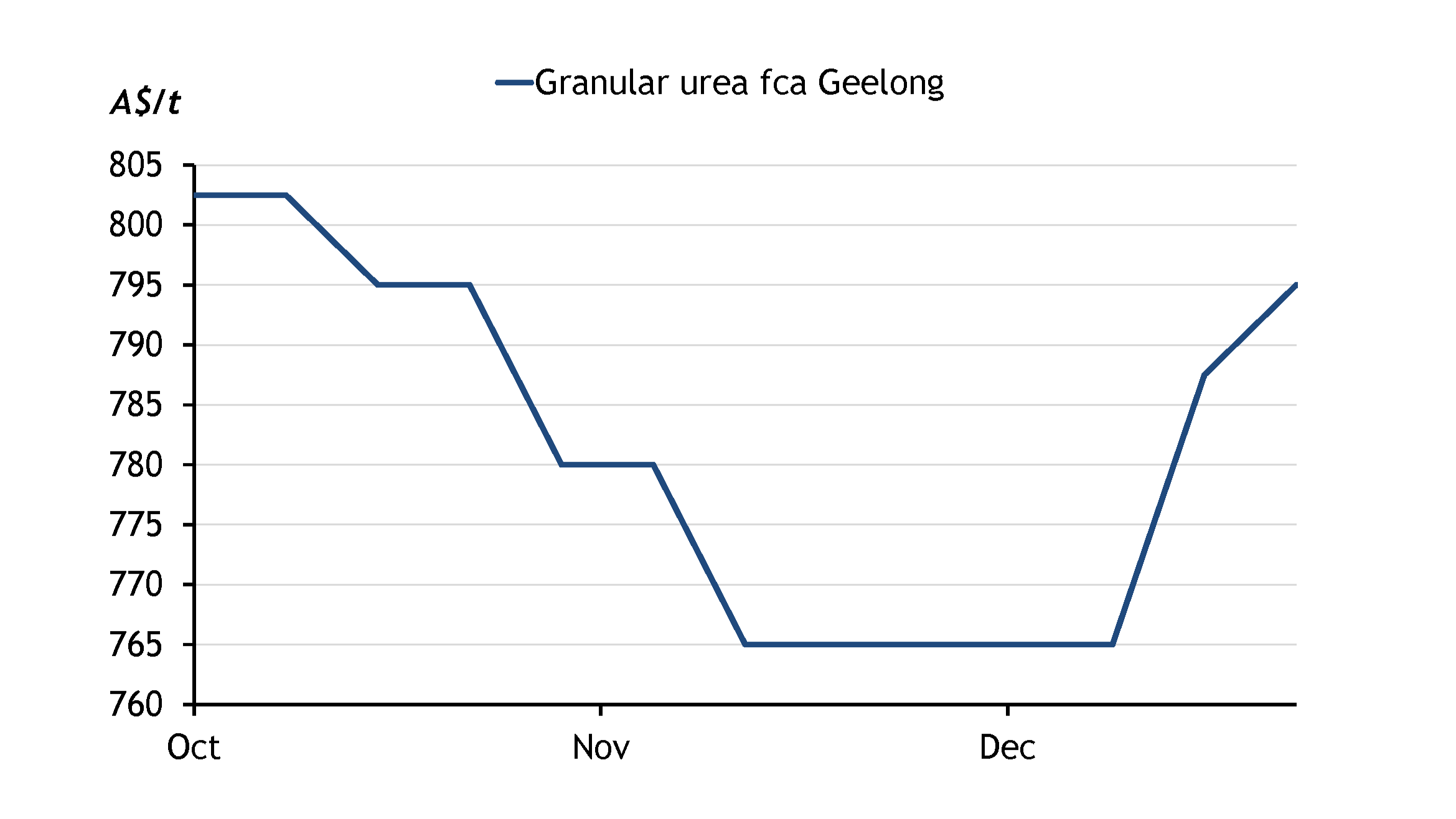

Granular urea was last assessed at A$790-800/t fca Geelong.

There are 162,000t of urea in transit to Australia across five vessels, vessel tracking data from Kpler show.

Phosphates

Local demand for MAP remains strong with heavy buying on the East Coast, but supply is believed to be sufficient to meet it.

There are nearly 500,000t of MAP, DAP and other phosphorous fertilisers in transit to Australia across 11 vessels, Kpler data show. Out of these vessels, five are from Morocco and four are from Saudi Arabia.

BHP’s Jansen potash project faces higher costs

Australian mining firm BHP has completed 75% of its 4.15 million t/yr Jansen stage 1 MOP project in Canada's Saskatchewan, but costs for the project's stage 1 have increased by $1bn-1.4bn, the firm said today.

New Zealand’s Balance gets gas supply for urea plant

New Zealand fertiliser distributor Ballance Agri-Nutrients has secured a short-term gas supply for its 260,000 t/yr Kapuni urea plant through March this year, it said today.

Ballance has required short-term gas supply for the plant since its long-term contract expired on 30 September, the company said on 22 January. The Kapuni plant relies entirely on natural gas both as a feedstock and as a fuel source for urea production, meaning rising gas prices directly increase urea manufacturing costs.

Commentary and pricing supplied by Argus Media

Disclaimer: The information provided in this report is general in nature and is intended for informational purposes only.